|

Long Term Care Insurance (Asset-based LTC approach)

Estimated cost of LTC in 20 yrs based on averages:

- $166,300 per year @ 2.2 yrs for men = $365,860

- $166,300 per year @ 3.7 yrs for women = $615,310

- $166,300 per year @ 8 yrs for Alzheimer's = $1,330,400

According to The National Long-Term Care Clearinghouse:

About 70% of individuals over age 65 will require at least some type of long-term care service during their lifetime.

Over 40% will need care in a nursing home for some period of time. Women need care for longer (on avg. 3.7 years) than do men (on avg. 2.2 years).

Source: U.S. Department of Health and Human Services, www.longtermcare.gov, 4/12/12

"If you need long term care, how would it affect your family?"

The four important considerations when a loved one needs care:

- Spouses - Many times the stress of caring for a chronically ill loved can impact the health of the caregiver as well.

- Children - When the spouse isn't involved, other loved ones carry the burden. Often the eldest daughter quits job, moves in or moves parent in her home, gives up career - as any child would probably feel obligated to do.

- Family dynamics - When informal care is needed, it may not be shared equally amongst the adult children. Often one sibling bears the burden and it can affect the relationship with siblings.

- Unnecessary losses - You can never avoid all losses; however, the unnecessary spiritual, emotional, financial, and familial losses could be mitigated when one prepares.

"How will you pay for it?"

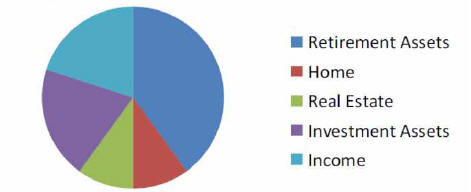

Self Funding Options:

Insurance Options:

Your chances of needing LTC during your lifetime are either 0% or 100%

"Protect Yourself, Your Family and Your Assets!"

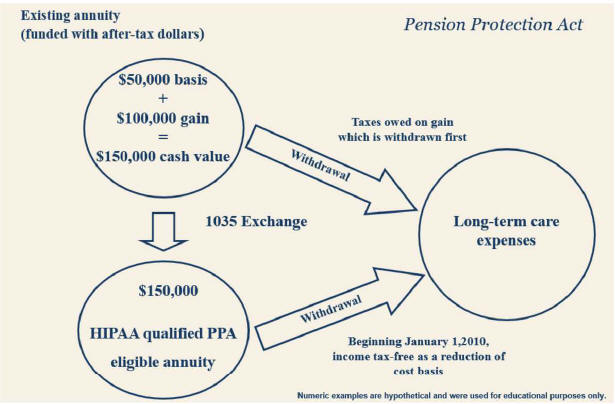

Pension Protection Act of 2006 not only provides tax clarification of long term care insurance combination policies, but also the ability to pay long term care insurance premiums in a tax-advantaged way using life insurance or annuity cash values.

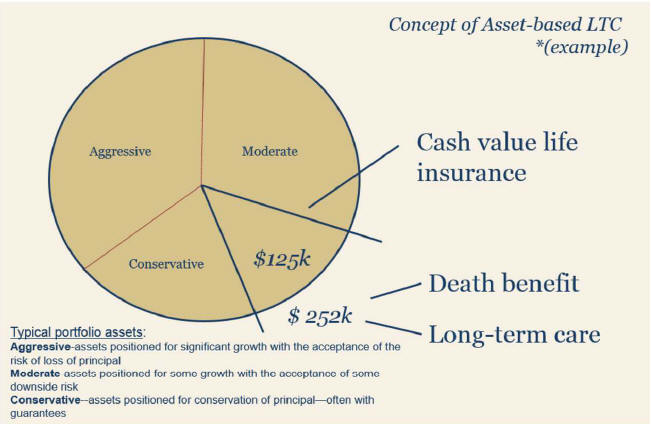

Asset-based LTC

Asset-based long-term care policies work by leveraging existing assets to help pay for long-term care expenses only if they are needed. If long-term expenses are not incurred, the assets pass on to your heirs. And yes, you are allowed to change your mind, you may "CASH-OUT" at any time!

EXAMPLE: $125k cash value life insurance = $252k LTC benefit or $252k death benefit. Quit - Live - Die

Want to learn more?  Click here and complete the confidential survey, or call 331-302-7266 where an experienced LTCi expert is ready to assist. Click here and complete the confidential survey, or call 331-302-7266 where an experienced LTCi expert is ready to assist.

|

I hear and I forget.

|

|

I see and I remember.

|

|

I do and I understand.

|

|

--Confucius

|

|

To contact a LTC insurance agent in Naperville, Illinois call 331-302-7266

|